A vaping tax, one-off increase in tobacco duty, and a cut to employee national insurance contributions were among the economic policies impacting retailers announced today in the Spring Budget.

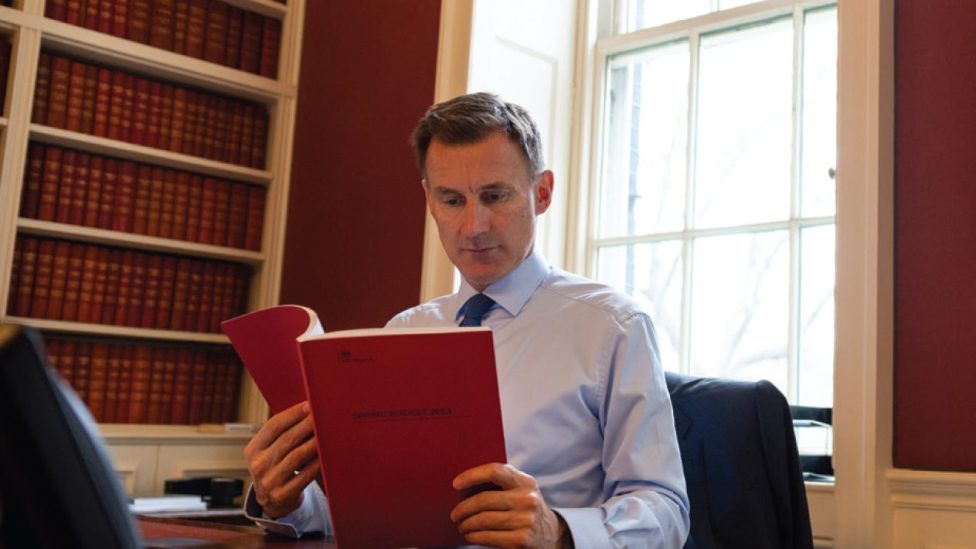

The duty increase on tobacco, an additional 20p per 5g of tobacco or cigarettes, is intended to provide “a financial incentive to pick vaping over smoking” when a levy is placed on e-liquids from 1 October 2026, said chancellor Jeremy Hunt. These measures are part of the aim to raise money for tax cuts, with the e-liquid tax consisting of three rates for nicotine-free, nicotine (less than 11mg/ml), and high nicotine (at least 11mg/ml). These will add £1, £2 or £3 respectively to every 10ml of e-liquid sold.

Alcohol duty will also be frozen until 1 February 2025, after originally being planned to stop in August this year.

A National Insurance cut of 2p follows a previous 2p fall in last year’s Autumn Statement, and could allegedly save the average worker £450 a year, with the reduction representing a fall from 10% to 8%. The government hopes this could stimulate weak consumer spending.

The economic changes have been announced following news that the UK fell into recession last year, and overall tax take is approaching record levels.

Measures also included an increase to the landfill tax, likely to be passed on to stores through higher waste fees. The standard rate will increase from £103.70 per tonne to £126.15 per tonne, while the lower rate will rise from £3.30 to £4.05 per tonne.

Hunt also shared that the Office for Budget Responsibility (OBR) has reported that inflation will go below the Bank of England target of 2% in a few months’ time, nearly a year ahead of the previous OBR statement. Partly as a result of that, real disposable income is forecast to go up a little, having been forecast to fall by 2%.

Industry responses

Rupert Lewis, Tobacco Manufacturers’ Association (TMA) director, told Better Retailing: “An increase in tobacco tax will undoubtedly have unintended consequences and especially for retailers. Today, the average 20-pack of legal cigarettes costs £15.26, while according to TMA research a 20-pack of illegal, untaxed and unregulated cigarettes costs on average £5.00.

“Each time the government increases tobacco taxes its handing over an ever-larger share of the UK tobacco market to criminals and fuelling the profits of organised crime groups. Once consumers are priced out of buying legal tobacco, they are increasingly receptive to buying illegal tobacco, which is obtainable everywhere in the UK.”

John Webber, head of business rates at Colliers, said: “Given the Chancellor confirmed today that the OBR has forecast inflation to be below 2% in 2 months’ time, it is outrageous that all but the smallest of UK businesses will be paying increased business rates tied to a multiplier that will increase from 51.2p to 54.6p in the pound in line with the 6.7% inflation figures of last September. This planned increase will impact 220,000 businesses who will pay an extra burden of £1.66bn in tax from April 1, 2024.

“Another issue that could impact retailers, that wasn’t mentioned, is empty property relief. If you’re a retailer holding empty property, you’re going to be paying 25% more than you were before, from 1 April.”

Chris Kelly, director of Phoenix 2 Retail, said: “From an independent convenience perspective, we’re not opposed to some form of taxation or new regulation if implemented in the right way, but at the moment it’s a little rushed. There’s been taxation on cigarettes for years and they haven’t managed to eradicate illicit cigarettes. It’s about enforcing the regulation already in play to restrict the illicit market. We need to make sure independent retailers are supported by trade bodies.”

Comments

This article doesn't have any comments yet, be the first!