Chancellor Jeremy Hunt is said to be planning to use next week’s Budget to announce a new levy on liquid in vapes, in addition to the VAT already placed on the products, according to national newspaper The Times.

Tobacco duty could also increase at the Budget, sources have said, as the government is looking to put a higher tax on products with more nicotine, while vaping remains the cheaper choice.

Mo Razzaq, of Family Shopper, Blantyre, Glasgow, told Better Retailing: “I’m not surprised and I’d understand the tax being based on nicotine strength, but the level of the tax will be very important. There’s already a large illicit trade and price increases on legitimate stock will fuel this. Hopefully, with the government benefiting from legitimate sales through a tax, they have more incentive to actually tackle the illicit vape problem.

The news follows the UK government announcing plans to crack down on the tobacco and e-cigarette industry in January to tackle youth vaping. A ban on disposable vapes could be implemented as early as the end of this year, alongside restrictions on flavours and packaging within the sector, with retailers set to lose thousands in profits when the ban goes comes into force.

Treasury analysis suggests the new vaping tax, along with the rise in tobacco duty, could eventually raise around £500m a year.

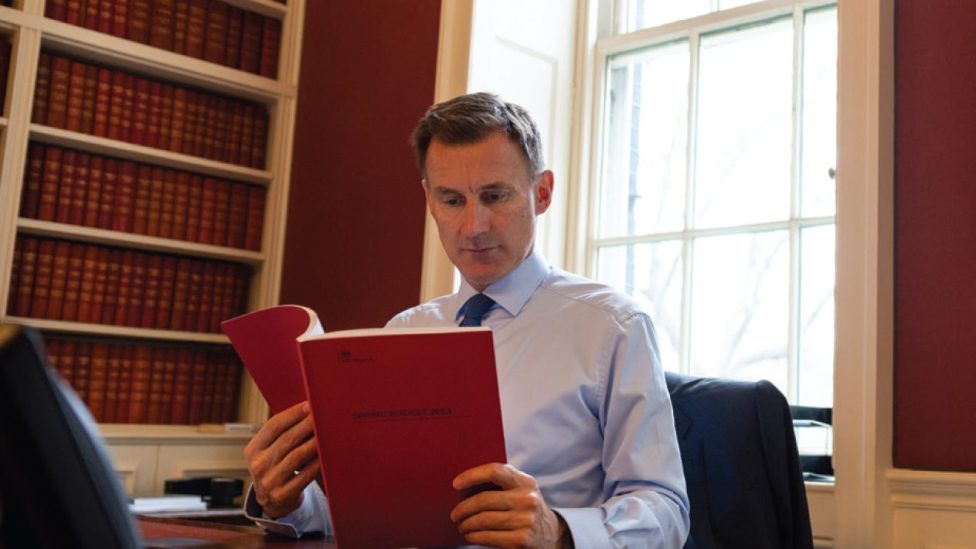

The new levy is being considered amid reports that Hunt is having to significantly scale back planned cuts as there is ‘less money to spend than expected’, said The Times.

Retailer views ‘ignored’ in disposable vape ban consultation

Cuts announced in the Autumn Statement included an extended 75% discount on business rates for retail and hospitality businesses and a reduced rate of National Insurance contributions.

Andrej Kuttruf, CEO of UK-based vape company Evapo, said he is concerned to see reports of a potential tax rise on vaping liquids.

“A tax increase would send the wrong message to smokers,” he continued. “Vaping is at least 95% less harmful than smoking, according to Public Health England, and twice as effective in helping smokers quit compared to any other method. Taxing both in the same way risks muddying that message.

“A tax increase would pour petrol on the flames of the already flourishing black market and should only come with a big step up in efforts to tackle the black market through increased border controls to stop illicit and untaxed products coming in.

“Raising taxes on vaping liquids could also make it harder to supply the smoking cessation market, injecting uncertainty into local authorities’ budgets for smoking cessation programs like Swap to Stop.

“Evapo believes the best way to stop the criminals that sell vapes illegally is by introducing a common sense, evidence-based licensing regime, as was published in parliament last week. Allowing retailers to pay an annual fee will keep standards high, enable enforcement, help smokers quit, and bring in more tax revenue than the government’s current approach of bans and tax rises.”

Comments

This article doesn't have any comments yet, be the first!