This is a response by EzeeCopy to allegations of misrepresenting contract terms made by retailers in a court trial initiated by EzeeCopy. For the original article, click here.

We currently have over 2000 pieces of equipment installed nationwide majority of which are independent stores. The vast majority of our customers are happy and some have been customers for over 15 years. We have been operating for 22 years and for most of that period regularly advertised in the Retail Express and Retail News promoting the Agreement taken up by Mr Kumar and many other satisfied retailers. We have used fundamentally the same Agreement during this period updating it as required to comply with any legislative or regulatory changes. The Agreement over this period has been accepted and agreed by the OFT and currently the FCA (Financial Conduct Authority).*

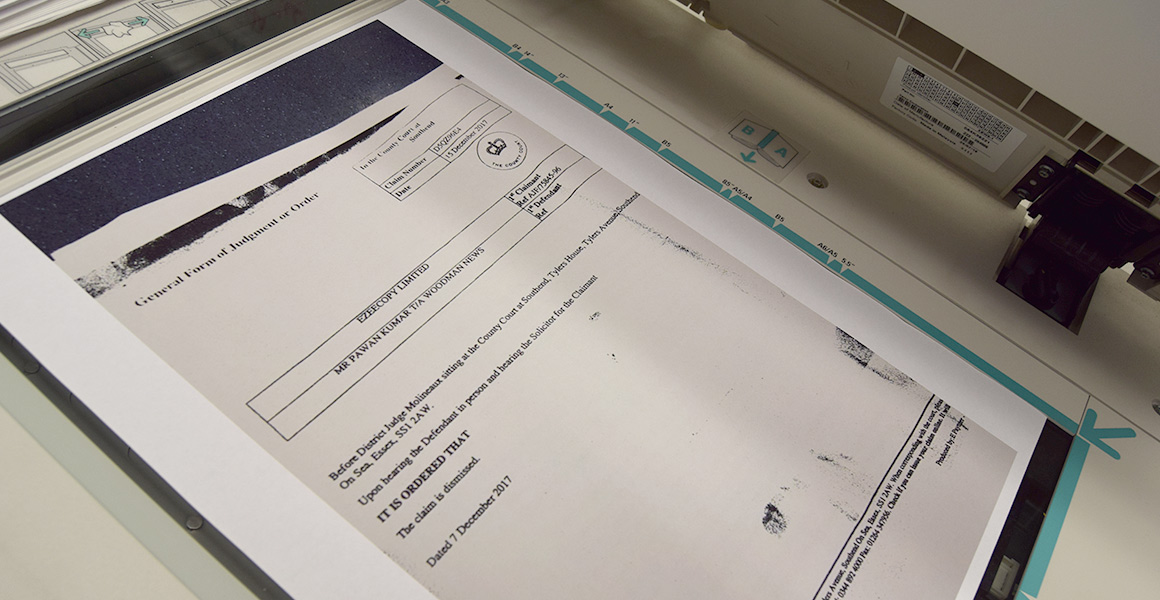

Inevitably over this period of time we have had court cases for a variety of reasons and to date have a success record of 99.2%. The Agreement has never been found as void because logically if it had we would have taken the appropriate action. Our Agreement has been drawn up by a Consumer Credit expert at a national reputable law firm DWF LLP who reviewed it as recently as 22nd September 2017 and confirmed it met all current regulatory requirements and stated the terms and conditions clearly.

Essentially the claim was not proven because our Sales Agent did not leave a copy of the Agreement with Mr Kumar, this is because the Agreement is subject to passing a valid credit check and therefore does not become executed until this check is done by us after we have received the Agreement back at Head Office from the Sales Agent.

Mr Kumar confirmed during the hearing that he had not asked the Sales Agent to leave him a copy of the Agreement to look over and come back another time. He had not asked the Sales Agent for clarification as to the terms or ask for any further time to read through them. He had made no effort to read through them thoroughly at the meeting. Our Sales Agent would happily have left a blank copy with Mr Kumar if requested but as stated previously we could not guarantee he would be accepted until the credit check had cleared. Currently 18% of customers fail the credit check.

The use of a Sales Agent (who is not employed by us) is extremely rare and happens in less than 1% of our Agreements. Our normal practice is to converse with the potential customer over the telephone and then conduct the credit check before posting out two copies of the Agreement to their place of business for them to read and review at their own leisure, returning one copy to us at their convenience, if they wish to proceed keeping the second copy for their own records. We only use Sales Agents very occasionally and this is only if the customer specifically requests a sales person to visit their premises.

The Judge in her opinion concluded that we had not proven we had sent the final executed agreement to Mr Kumar which we did along with a cooling off letter (only applicable for face to face selling) but as we were unable to provide a proof of postage due to an administrative error on this occasion it went against us. We are revising our internal procedures to ensure this does not happen again.

The Judge in the summary of her judgement never uses the word Misrepresentation. In this case she found for the Defendant as she was not satisfied following questioning our Sales Agent on the day of the hearing that the terms and conditions of the Agreement had been explained fully acknowledging that the meeting was interrupted by Mr Kumar serving customers and so unable to give the Agreement his full attention.

She was not satisfied that our Sales Representative had not explained the terms of the agreement fully to Mr Kumar, but Mr Kumar himself argued that he was unable to give the Agreement his full attention as he occasionally left the meeting to serve customers.

Regarding alleged “similar complaints from other retailers” I refer you to what Mr Kumar replied during cross examination:

“I referred Mr Kumar to the witness statements of other Ezeecopy customers. Mr Kumar confirmed that he had not seen copies of the agreements between those customers and the Claimant. He confirmed that he did not know what terms and conditions applied to those agreements. He confirmed that he did not know what representations were made to them before the agreements were entered nor were they here to tell the Court. Mr Kumar accepted that he did not know the contracts of those witnesses and the circumstances leading up to their contracts being entered into and if they were in any way similar to his.”

This was the Judges comments in her summing up:

“There are other statements from the Defendant that relate to other customers of the Claimant. I give little weight to this evidence. I do not have any information about their agreements nor the representations that were made to them.”

* The FCA said that it does not endorse services or agreements, and that business to business contracts are normally not regulated by the FCA. In response, EzeeCopy has asked Retail Express to change their earlier statement to the following: "The Company was initially regulated by the OFT (Office of Fair Trading) and is currently authorised and regulated by the FCA (Financial Conduct Authority) in respect of those agreements used by the Company that fall within the CCA (Consumer Credit Act). The Company’s FCA authorisation number is 653158."

Comments

This article doesn't have any comments yet, be the first!