It is inevitable that the recession or even depression that we are facing will hugely increase the importance of offering value for money. Multiple grocers are likely to have aggressive pricing and promotional strategies as they fight for share of the consumer pound, meaning convenience stores will once again need to differentiate their offers to compete.

In the three weeks since disruption has really kicked in we have seen retail performances range from +80% in grocery to -100% in foodservice, clothing and holidays. In the new normal we will all still eat and drink, need to work, require shelter and energy to move around. How we do these – and also have some fun – will be very different to where we were in February.

A new report, ‘The Shape of Food Retailing in the New Normal’ by convenience experts Scott Annan and Dev Dhillon, discusses what this could mean for brands, retailers and consumers. Here, we have selected five things store owners can learn about the way shoppers are changing:

1. There will be less disposable spend

Food retailer trust, convenience and careful spending will be key for the balance of 2020 and through 2021. Increased hygiene and social distancing habits will not completely disappear.

There will be a surge in demand when our movement restrictions are lifted but not across the board. Spending plans will be reined in and disposable spending, be that a restaurant meal, a new outfit, a holiday or a new car, will be curtailed as living standards are hit through the coming multi-year recession.

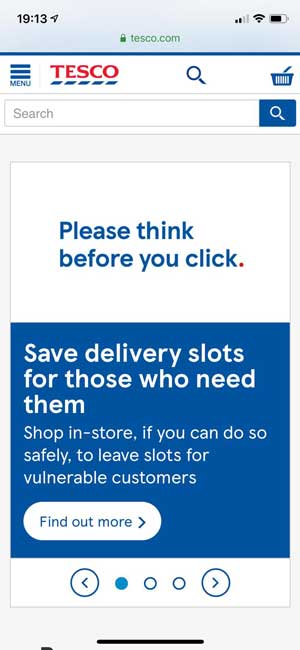

2. Bad business conduct will be punished

Businesses that make inappropriate demands or behave badly during this crisis risk losing customers, demoralising their staff and slipping towards irrelevance.

Businesses with clear leadership and vision, purpose and clarity and that demonstrate their role in benefiting the whole will be stronger in the new normal.

Retailer social responsibility has moved towards the standards and actions ingrained in Japanese retailers when national disasters such as the 2011 Tōhoku earthquake and tsunami occur.

Big changes will be required in the next three years and those businesses that maintain the highest standards of conduct across the board will come through fitter and more resilient for the next crisis, built on their unswerving customers.

3. New supply chains, new partnerships

Many UK independent retailers were focused on a purchasing strategy within their wholesale supply chains. Now, independent and multiple retailers are sharing ideas and resources and finding new sources of supply and ways to interact with consumers.

Suppliers and wholesalers have developed new survival strategies during this lockdown with entirely new operating procedures. Some wholesalers, foodservice providers and suppliers have taken a direct route to consumers.

Before the lockdown, the crisis on British high streets, in quick food eateries and shopping centres was a toxic equation of business rates, rents, cost inflation, weak balance sheets, increasing crime, lack of investment and a growing consumer preference for online shopping. These will not go away in the new normal even with the government’s temporary financial reliefs.

The restaurant, quick food and hospitality sectors have taken a massive commercial hit. Thousands of businesses were already vulnerable as they operated on a weekly cash flow model and will not open again.

4. Investments will slow, but you can be the exception

All non-critical capital investment will be severely curtailed with three important exceptions: health, education and resilient retailers with the funds to adjust their offer.

National retailers and wholesalers will work closely with their third-party suppliers on curated availability and to reduce costs. Shared investments in home delivery and ‘Scan, pay, go’ platforms will become normal within the government’s easing of competition law restrictions.

UK economic output will decline by 15% and unemployment will double in the second quarter of the year, according to the Centre for Economics and Business Research (CEBR). It expects the steepest contraction since comparable records began more than 20 years ago.

5. Get ready for a new tech-savvy shopper

It has taken two weeks for us all to become tech savvy.

Demand for online shopping with home delivery or dedicated pick-up points will at least double in the next year. Off-the-shelf platforms are available such as Shopify and Big Commerce and more will emerge.

Many companies are using white-label delivery apps to go from in-store browsing to delivery. Social distancing, hygiene and customer order fulfilment massively support a surge in the use of mobile app technologies.

Independent retailer groups such as Booker’s symbol stores, Costcutter, Nisa and Spar will share ideas and resources as government approved competitor collaboration is now seen as beneficial.

The self-service till is now redundant, like the typewriter, and the ever-steepening technology adoption curve will see the market for traditional scanning tills all but disappear in three years. Expect to see retailers demanding that their EPoS providers integrate with mobile ‘Scan, pay, go’.

Click here for more insights from The Shape of Food Retailing in the New Normal

Find out more on our coronavirus information hub for retailers

Comments

This article doesn't have any comments yet, be the first!