Retailers are still unclear about the government’s online tax return system being enforced in less than three weeks.

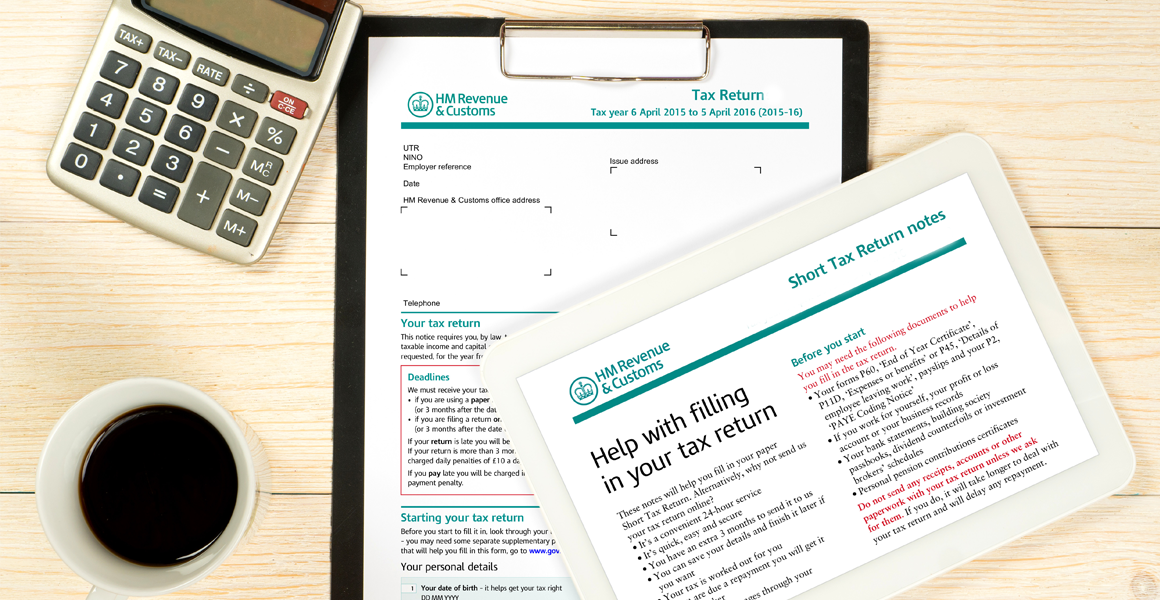

From 1 April, businesses with a taxable turnover above the £85,000 VAT threshold must submit their returns through the government’s ‘Making Tax Digital’ (MTD) online service. Businesses who register for the new system will be able to view their tax records in real time, update information, register for new services and choose payment options from one place.

However, the software retailers use to submit their tax returns is not provided by HRMC, but through government-approved third-party providers instead.

Ravi Raveendran, of Colombo Food and Wine in Hounslow, told RN the software would come at an extra cost for retailers.

“I’ve had conversations with my accountant, who said the software will cost extra. It’s unclear what the cost will be, but it’s adding to our overheads.”

Ken Singh, of Love Lane Stores in Pontefract, added: “Retailers aged older than 60 might have difficulty with MTD because they’re not as internet- or computer-savvy.”

For more information on preparing for MTD, call RN on 020 7689 3358

More recent news: Crime-fighting MP vows to support independent retailers

Comments

This article doesn't have any comments yet, be the first!