Shoppers are increasingly looking for premium options in a range of core convenience categories, and chocolate is no exception. Priyanka Jethwa explores the trends that can help you boost your sales and profits

Big brands

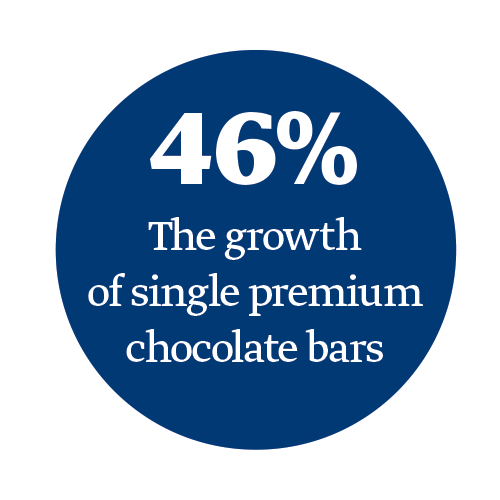

Premium chocolate is the fastest-growing chocolate segment, bringing new and higher spending shoppers to the category. Premium ranges within the chocolate category are becoming an increasingly important part of a retailer’s range, as shoppers say that if they are going to have a treat, it should be something they really enjoy.

Susan Nash, trade communications manager at Mondelez International, says to capitalise on the increasing popularity of premium varieties, Green & Black’s launched two new singles bars last summer: Green & Black’s Truffle and Green & Black’s Praline.

Susan Nash, trade communications manager at Mondelez International, says to capitalise on the increasing popularity of premium varieties, Green & Black’s launched two new singles bars last summer: Green & Black’s Truffle and Green & Black’s Praline.

“Not only does this launch capture the attention of the increasingly popular premium singles segment – which is growing at 46% – but it meets the needs of shoppers looking for luxurious and new options,” she says.

Nash adds that retailers can take advantage of shopper demand for premium chocolate this

Easter by stocking up on the egg range available from Green & Black’s – in dark, milk and butterscotch varieties – to tempt shoppers looking for special treats to give as gifts.

Levi Boorer, customer development director at Ferrero, says the premium part of the sharing category is also growing at 15% year on year, and is a sub-category that retailers should focus on to increase sales as well.

“Last year, Thorntons introduced a packaging redesign across its Continental range to emphasise the variety of premium, handcrafted chocolates within,” he adds.

Mars Wrigley Confectionery also took its first steps into the premium chocolate sector in 2018 with the launch of Maltesers Truffles, designed as a treat to gift.

Rebecca Shepheard-Walwyn, Maltesers brand director at Mars Wrigley Confectionery, says the seasonal and boxed confectionery category has outperformed the total confectionery market for the past three years, mainly driven by shoppers favouring premium chocolate, which has grown at 10 times the rate of standard chocolate.

She adds: “Maltesers Truffles’ extension into premium gifts will drive additional growth to the category, representing a £20m opportunity.”

Offer something special

While offering a range of premium options from big suppliers is a great way to increase sales and attract the attention of shoppers already familiar with those brands, retailers looking to become a destination for luxury options should look further afield to artisan brands.

MIA is a chocolate brand that promotes its ethically-sourced ingredients. It offers a range of premium single and multipack varieties in flavours that aren’t readily available from major suppliers, such as Baobab & Salted Nibs and Hemp & Almond.

MIA co-Founder Sarah Lescrauwaet says there is a growing appetite in the UK for premium chocolate that tastes great and, at the same time, is ethically produced.

Speaking about its latest flavour, Hemp & Almond, she explains: “Hemp is definitely an ingredient going places in the food industry and works wonderfully alongside almonds and chocolate, so we are excited to see what people think.”

Meanwhile, with the growing number of shoppers choosing to adhere to certain diets, or who have food intolerances, it’s important retailers manage a premium range that also caters to their needs.

Meanwhile, with the growing number of shoppers choosing to adhere to certain diets, or who have food intolerances, it’s important retailers manage a premium range that also caters to their needs.

Last year, artisan chocolate producer Gnaw Chocolate launched a range of 72% cocoa dark chocolate bars in two flavours, Toasted Coconut and Raspberry Crisp. The premium 100g bars are suitable for vegetarians and dairy-free, with its Toasted Coconut bar also being gluten-free.

Matt Legon, founder at Gnaw Chocolate, says: “By keeping a close eye on the market, we developed our high-cocoa 72% range in response to consumer demand. We are pleased to be able to respond with our chocolate bars, that are suitable for the growing number of people living with food intolerances.

“Any retailer looking to capitalise on the consumer demand for free-from chocolate and increase their confectionery sales should invest in a strong range.”

Retailer viewpoint

Long Ashton Post Office,

Bristol

We stock a range of premium chocolate from a brand called Ooh! Chocolata, which is a local supplier. We’ve been selling the range for six years, and were one of the first retailers to sell its products. The chocolates sell just as well as the mainstream brands, and recently we invested in their vegan and dairy-free varieties – so far they seem to be selling well. We’re based in a village with a population of around 4,000, and the only competition in our immediate area is a Co-op, but they don’t sell local brands, so it gives our store a point of difference. I’d encourage everyone to invest in local chocolate because not only are the margins available greater, but it gives you an edge over the multiples.

Want more advice? Sweet treats: Grow your confectionery sales

Comments

This article doesn't have any comments yet, be the first!